Almost all businesses these days accept credit and debit cards. For the privilege of accepting card payments, those businesses incur fees from whatever payment provider they use. The fee for accepting card payments is typically a low percentage (0.5% to 3%) of the transaction amount, and sometimes combined with another flat fee for each transaction.

Accepting payments with a card (or a phone) is a reality of doing business in our increasingly digital and cashless world. So that small fee businesses pay is a tradeoff they decide to accept, knowing that allowing payment by more forms than just cash or check will likely lead to more customers and a higher overall sales volume.

A personal decision

Individual families may decide to accept digital payments when selling Girl Scout Cookies for the same reason. Accepting card payments often leads to more sales and more customers, and eliminates the “I don’t have any cash on me” excuse we’ve so often heard. However, Girl Scout Cookie sales as card payments are still subject to the payment provider fees for each transaction, even though each of our local Councils are set up as nonprofit organizations*.

Some Councils have an official means of accepting credit and debit card payments. And those Councils sometimes agree to absorb the payment processing fees when the transaction is run through that official method.

Square fees, explained

Where Councils have not set up an official means, or for when a family wants to use a different card payment provider, Square is a popular choice, especially because of how simple and easy it is to get set up. Plus, Square card readers work with most mobile phones. But even Square charges fees for each transaction. This means you will not receive the entire dollar amount of each sale.

It’s important that you understand Square fees and their effects on Girl Scout Cookie sales and revenue before you decide to start accepting card payments. As of the time of this post…

Square’s standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in […] have a 3.5% + 15¢ fee.

So here’s a quick example: A simple 4-box cookie sale of $20 taken by inserting a customer’s chip card into Square’s contactless reader will incur a 62¢ in fees — ($20 × .026) + a flat $0.10 for the transaction. Square will eventually transfer $19.38 to your linked bank account for that sale, and it keeps the $0.62 fee.

But here’s the rub… Your Council or cookie baker doesn’t care that you used Square to take the payment for that sale. They are still going to deduct from your Troop’s bank account the full amount owed for those four boxes. (This deduction is minus, of course, what your Troop gets to keep per box, which varies by region, total sales, and reward selection.)

Fee responsibility

Accepting card payments during Cookie Season is something parents or guardians can decide to do. But families must pay for the cost of Square fees if accepting digital payments. As an extension of a nonprofit Council organization, Troops are typically not allowed to cover payment provider fees. Parents/guardians must absorb all transaction fees. This means families need to remit to the Troop the full cost for each box of cookies sold, regardless of how they took payment for each sale. So in the above 4-box example, the Girl Scout’s family is responsible for giving the Troop all $20 for that sale.

To make finances very clear cut and separated, Girl Scouts recommends that payment provider accounts (like from Square) should be linked to the parent/guardian’s personal bank account. NOT the Troop’s bank account. Troops are not responsible for monitoring what random transfers might come in from various families’ Square sales. So don’t link your Square account to the Troop’s bank account.

Parents and guardians are responsible for the full amount of each box sold, regardless of the payment method used for each sale. It doesn’t matter that the parent/guardian account will not receive the full amount transferred into their personal bank account. Square will withhold fees for each transaction they process, and only transfers the net remainder after its fees are deducted. This is the tradeoff cost your family makes in deciding to accept digital/card payments to expand potential sales.

Viewing fees on past sales

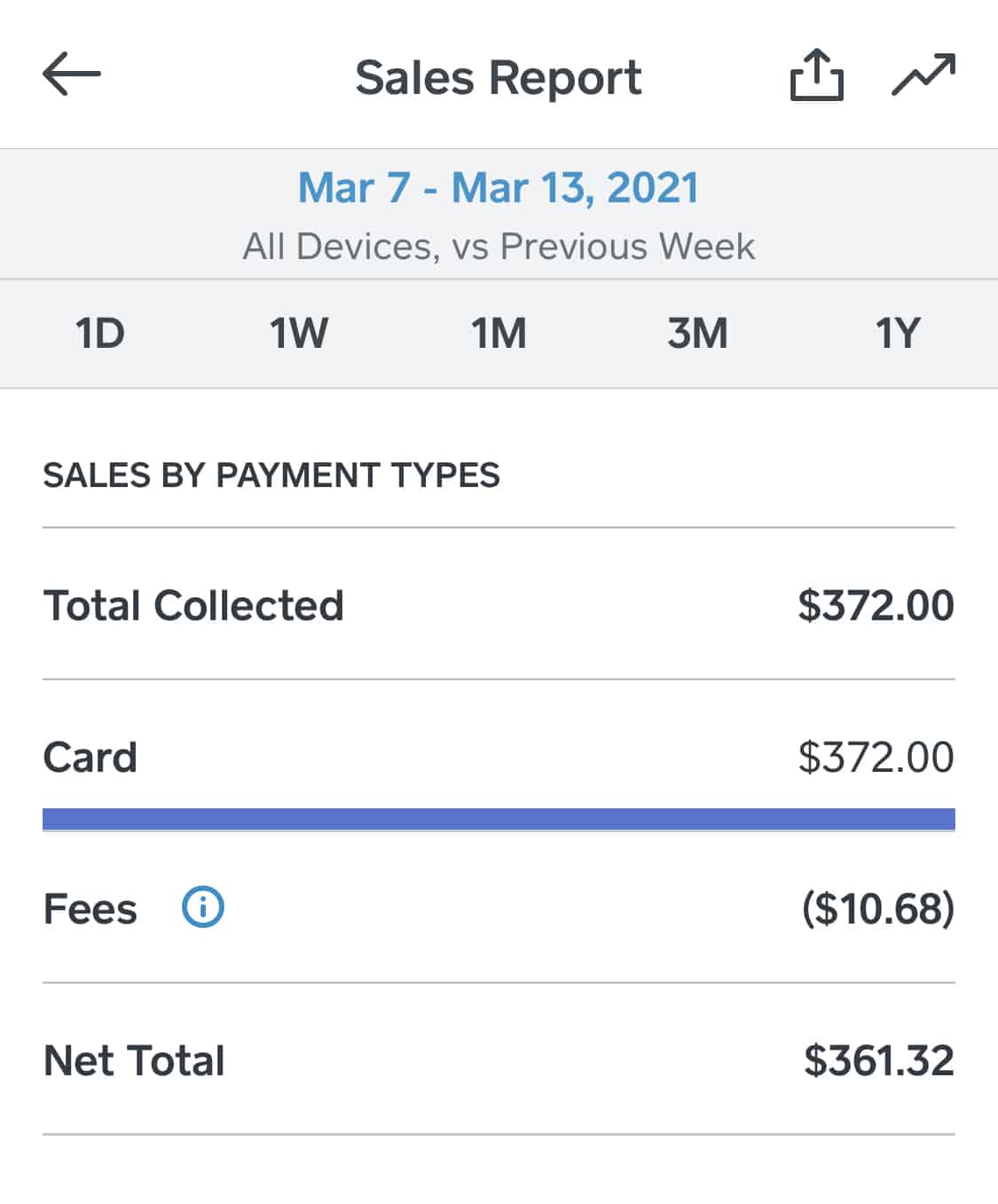

Square makes it easy to view simple Sales Reports within your account, whether from a desktop browser, or on your mobile device. Just go to your Square Dashboard > Reports > Sales (or Sales Summary), and select the day or date range you want to view. Scroll down until you see the Payments table. You’ll see amounts for Total Collected (all of your sales for the selected period), Fees (what Square takes out), and Net Total (the amount Square has transferred — or will soon transfer — into your bank account).

Viewing a Square Sales Report will allow you to see your tradeoff cost (in the form of Square fees) for accepting card payments through any date range. An example in the screenshot above shows we sold $372 of cookies sold through Square for a week in March. Square deducted $10.68 in fees, then transferred $361.32 into our connected bank account. That $10.68 is the cost we absorb as a family for the benefit our daughter gained from the extra sales she may not have had otherwise.

Once you understand how payment processing fees impact your sales revenue, you can make a more informed decision as to whether that tradeoff cost of accepting card payments is worth it to your family and your Girl Scout(s).

– – –

* Square does not offer lower rates for nonprofits, unless the organization is doing more than $250,000 per year in card processing. Given that families operate Square accounts independently, with rare exceptions, it’s unlikely that an individual family selling cookies would cross the $250k amount in card payments.